This technical analysis is utilising the Bollinger Bands. How we use it is as follows:

There are 2 modes with this TA:

- Normal

- Crossover (turn this on by ticking UseBollingerCrossover)

General Settings

The BollingerCandleHistoryCount is used to tell bot how long it needs to keep the signal for. Say, it receives a BUY/SELL signal, you can tell bot to store this signal for 1 hour. On a M5 chart, you would set this to 12 (meaning, 12 candles long). This setting is useful if you want to combine this TA with another TA.

Bollinger Bands MT4/5 indicator takes 3 parameters: Period, Deviation and Shift. You set these parameters using BollingerPeriod, BollingerDeviation, BollingerBandShift respectively.

Normal Mode

For Normal mode, basically bot will open BUY when price hits the top band, and SELL when price hits the bottom band. In some instances, the distance between upper and lower bands are very narrow (ie. during sideways movement). In this case, BollingerDistance is used to guard against this scenario. When bands are narrow, it is often not accurate. Use BollingerDistance to tell bot to only look for signal when upper/lower bands are within minimum %.

Crossover Mode

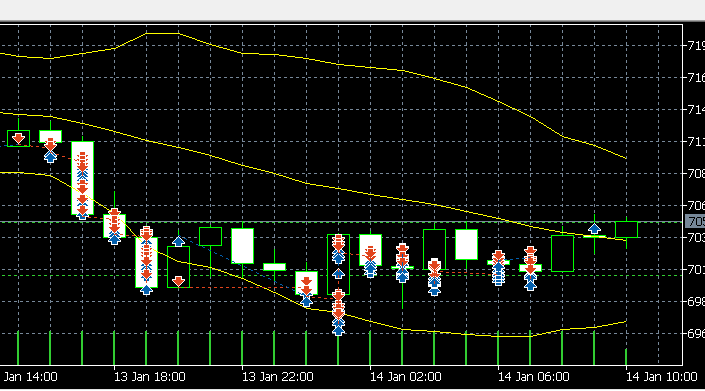

With Crossover Mode, bot will only open position when price crosses the middle band. For example, when price hits the bottom band, bot will start listening for signal. Once price crosses the middle band, it will then give the BUY signal.

BollingerUpperLowerBandCandleCounter is used to tell bot how many candles hitting the bottom/upper bands before the crossover for bot to take signal at. The reason is, during sideways movement, sometimes price hits upper/lower band, then it crosses the middle band, only to come back up/down to the upper/lower band. This feature is used to guard against that. During a real volatile movement, just like in the example chart above, price will hit upper/lower band few times before it finally crosses over and indicating a reversal.